India’s stock market is booming and reaching new highs thanks to the strength and potential of the country’s economy. The total value of India’s equities recently hit $3.5 trillion (Rs 290 trillion) as domestic and foreign investors are eyeing this bright spot amidst global economic fragility. An increasing interest in stocks among India’s youth and the growth of the urban middle class has also been driving stock market recovery and success. Online platforms have made it easier than ever to connect to the stock market, empowering retail investors. However, with increased digitalisation comes increased security risks. As such, here’s a look at why cybersecurity is crucial when trading stocks online.

Cybersecurity measures

With India emerging as a global IT superpower, the country has taken measures to protect data privacy and the online rights of citizens. The country scored a total of 97.5 points out of a maximum of 100 points on the Global Cybersecurity Index 2020, jumping 37 places to rank in the 10th position in the world. India will likely continue tightening and adhering to cybersecurity standards as tech becomes more integrated into society and industries, including stock trading.

Stock exchanges and financial regulators are facing more pressure to tighten cybersecurity to prevent trading halts, security breaches, and the exposure of investor data. Cyber threats and attacks can affect the security of the exchange servers and all related systems. This disrupts trading activity or settlements and can impact the credibility of the Indian stock market. The Securities and Exchange Board of India has been working on issuing a consolidated framework for cybersecurity and cyber resilience. The proposed framework has a set of rules in the event of cyberattacks, including asking relevant institutions to have a standard operating procedure for response and recovery. Vulnerability Assessment and Penetration Testing (VAPT) should also be conducted regularly to audit the systems when necessary.

Though India’s cybersecurity is improving overall, there are still strategies trading platforms and traders can employ to ensure cybersecurity when conducting trading online.

How trading platforms are ensuring security

Apart from cybersecurity measures in stock exchanges, trading platforms should also be prioritising security when it comes to traders’ accounts, data, and information. Because your financial information is needed to withdraw and deposit funds, cybersecurity is essential for protecting your money while online trading. Reputable brokers and platforms comply with important security standards, such as the Payment Card Industry Data Security Standard (PCI DSS), to ensure your security and privacy. Vulnerability scans and penetration tests should also be performed in accordance with PCI DSS and other cybersecurity requirements.

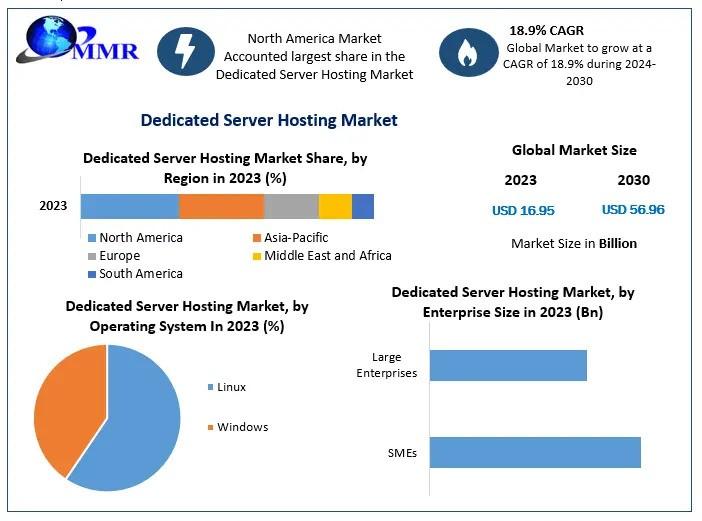

Some platforms may offer free virtual private server (VPS) hosting to provide a fast and secure trading environment, no matter where you are. With a VPS, you can access your account, operate in the financial markets, and run automated trading strategies from anywhere in the world without worrying about your Wi-Fi connection. Trading on a VPS can be more secure since you don’t need to share resources (memory, disk space, CPU cores, etc.) with other users.

How to stay secure while trading

Your trading account requires utmost security, as cybercriminals can hack into your account and misuse it, or someone else with access to it can find sensitive information. Platforms will often provide tools to verify the account owner’s identity. Certain account actions may require a code that can be sent to your email or phone to ensure that the account owner is the one carrying out the action.

Pins or passwords are also a measure that can help traders keep their accounts secure, and it’s important to keep such information confidential. Never share your codes, pins, or passwords with anyone. Your account password should also be strong enough that it cannot be easily guessed by others. Avoid using your name or important dates like birthdays or anniversaries. An alphanumeric password with special characters can keep your password secure, and it’s also good to change your password regularly to avoid hacks.

Ideally, you should also be wary of trading on public Wi-Fi networks, internet cafes, or shared computers to avoid revealing information or putting your data in a vulnerable position. It’s best to trade on your personal computer or phone and in your own network. A VPS can come in handy in this case since you have a dedicated server space to trade in. If you do use a shared computer or are in a public space when you trade, logging out when you’re done using your account or even if you have to step away for a bit can help you stay extra secure. It can be inconvenient to do so, but it’s better to be safe than sorry, especially when it involves your finances and something as high-risk as trading.

What’s next for cybersecurity?

Now that cybersecurity is becoming more of a priority in trading online and in the overall tech landscape, traders may soon be able to enjoy more security when trading online. India is quickly becoming a hotspot for cybersecurity innovations and is aiming to provide more ways to keep accounts, networks, and databases secure. Areas like malware research, vulnerability management or internet-of-things (IoT) security are major priorities for the country. The use of artificial intelligence and machine learning algorithms to identify patterns and anomalies that could indicate fraudulent or malicious activity also makes it easier to tamp down security threats. These solutions, coupled with the frameworks and standards being worked on by SEBI and trading platforms, can help tighten India’s cybersecurity when it comes to online trading.

Cybersecurity is also a crucial area that needs constant attention and evolution as cybercrimes and scams become more sophisticated and challenging to distinguish from genuine activity. Retail investors using online platforms to trade must also be wary of these threats, even if these apps have cybersecurity measures in place. Cybersecurity education and digital literacy are necessary for all people to learn and be aware of, and aren’t just reserved for professionals or tech-savvy individuals. Being smart about security can be integral to protecting information and data when trading or doing anything online.

https://indiacsr.in/ensuring-cybersecurity-trading-stocks-online/