In other news, TNS adds server support to its cloud platform, JPMorgan converts mutual funds to ETFs & CEDX gets a direct link to the world.

ISITC & TCC Form Partnership

Securities operations standards group ISITC has begun a partnership with the Tokenized Commodities Council (TCC) “to advance the understanding and adoption of digitized real world assets,” officials say.

The nonprofit trade association TCC is “dedicated to educating the investment community and wider public about the benefits of and best practices around the tokenization of commodities,” officials say.

The new collaboration will help both organizations “leverage their collective expertise and resources … [to] empower industry participants to navigate the complexities of digitization and tokenization effectively,” according to the announcement.

“ISITC has been an integral part of TCC’s Taxonomy Working Group, which aims to develop a standardized framework for classifying and categorizing tokenized commodities,” officials say.

The partnership will accelerate “their mission of establishing safe, accessible, and desirable new investment asset class while promoting fair and sustainable industry practices,” officials say. “ISITC has similarly been at the forefront of digital asset adoption, consistently leading the way in creating and implementing market practices for currencies, assets, commodities, and funds through its Digital Asset Forum.”

“The collaboration with ISITC marks a significant milestone in our mission to educate the financial community,” says Silvana Da Luca, chair of TCC, in a prepared statement.

“Tokenization is revolutionizing the vast $12T commodities sector, fostering economic inclusivity while offering numerous advantages, such as enhanced liquidity, transparency, and measurable ESG impacts,” Da Luca says. “We are thrilled to join forces with ISITC, and together advance digital asset adoption, set new industry standards, and create actionable knowledge that will change the way people perceive, trade, and invest in commodities.”

ISITC has the support of investment managers, broker-dealers, custodians, utilities, and technology vendors to develop standards and best practices to increase operational efficiencies for the securities industry, officials say.

The TCC is focused on “tokenizing precious metals and continues to expand to other commodity types in the metals and mining, agriculture, energy, and lifestock sectors,” officials say.

TNS Adds Server Management to Cloud Platform

Transaction Network Services (TNS) has expanded its TNS Cloud platform by introducing TNS Cloud — Server Management, which offers end-to-end server management alongside cloud data center services, TNS officials say.

Transaction Network Services (TNS) has expanded its TNS Cloud platform by introducing TNS Cloud — Server Management, which offers end-to-end server management alongside cloud data center services, TNS officials say.

TNS Cloud – Server Management has been “designed for high-performance exchange trading” and uses TNS’s servers and ultra-low latency trading connectivity, officials say.

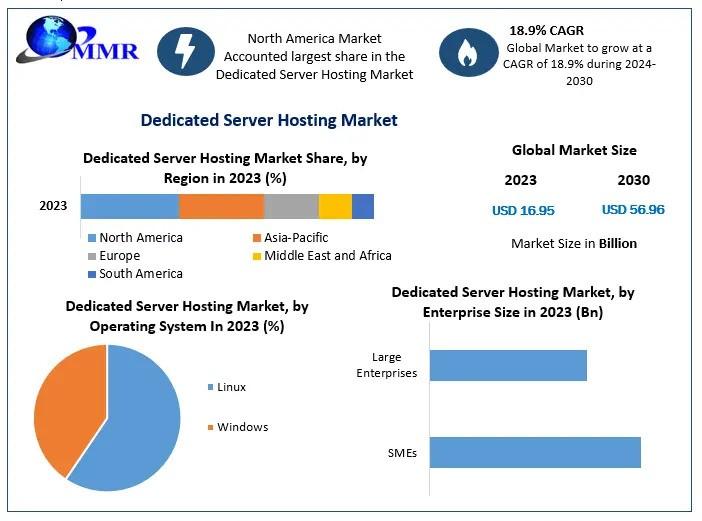

TNS Cloud – Server Management combines TNS’s Dedicated Server hosting capabilities with server management, officials say. This end-to-end offering is intended to reduce clients’ trading center complexity and costs.

“Up until now, trading organizations often outsourced cloud data center services, but still had to manage their own server resources,” says Jeff Mezger, vice president for product development for its financial markets business at TNS, in a prepared statement.

TNS Cloud – Server Management offers custom services such as:

- Operating system installation, configuration, and management;

- Server hardware and operating system health monitoring; and

- User access management.

TNS offers connectivity, colocation, cloud, market data and virtual private network (VPN) solutions within its Infrastructure-as-a-Service (IaaS) portfolio, officials say.

JPMorgan Converts 4 Mutual Funds to ETFs

JPMorgan Asset Management has “completed the conversion of four mutual funds to ETFs [exchange-traded funds],” officials say.

JPMorgan Asset Management has “completed the conversion of four mutual funds to ETFs [exchange-traded funds],” officials say.

“The conversion of these funds to actively managed ETFs will provide investors with active investment options in markets traditionally available to ETF investors through mostly passive solutions,” officials add.

“The following four ETF conversions means shareholders will benefit from intraday trading, liquidity, and reduced fees and may benefit from greater tax efficiency,” officials say.

“Investors are looking for differentiated active capabilities in the ETF wrapper. As conversions, these ETFs have a track record and scale from Day 1 and add to our active range of ETF providing tools for investors to meet their investment goals,” says Bryon Lake, global head of ETF Solutions at JPMorgan Asset Management, in a prepared statement.

The conversion to “active ETFs can provide … additional trading flexibility, increased transparency and reduced fees through transparency at attractive price points,” Lake says.

“The combined assets of the four active, transparent funds converted are approximately $1.5 billion. J.P. Morgan Asset Management ranks as a top ten ETF issuer in the U.S. with respect to AUM, and number one year to date in net active flows across active ETFs in the U.S.,” officials say.

JPMorgan Asset Management had assets under management of $2.67 trillion as of 3/31/2022, officials say. The firm offers global investment management in equities, fixed income, real estate, hedge funds, private equity and liquidity. J.P. Morgan ETFs are distributed by JPMorgan Distribution Services, Inc., which is an affiliate of JPMorgan Chase & Co.

CEDX Gets Global Link via ION’s XTP Execution

Cboe Europe Derivatives (CEDX), a pan-European equity derivatives exchange, will be getting new, direct access to global markets via the deployment of the XTP Execution solution from ION Markets, officials say.

Cboe Europe Derivatives (CEDX), a pan-European equity derivatives exchange, will be getting new, direct access to global markets via the deployment of the XTP Execution solution from ION Markets, officials say.

ION offers trading, analytics, treasury, and risk management solutions for capital markets, commodities, and treasury management, officials say.

“The addition of CEDX has further extended XTP Execution’s market coverage for ION’s customers and their end clients. CEDX currently offers futures and options on key single country and pan-European equity indices and is expanding into pan-European single stock options from November 2023, subject to regulatory approvals,” officials say.

XTP Execution is part of ION’s suite of cleared derivatives trading products, officials say. “The solution offers fully automated trade workflow with integrated order management, advanced order execution, and unrivaled connectivity to global markets,” officials say. “This is aligned with CEDX’s objective of promoting bigger, more liquid and screen-led markets for European equity derivatives.”

“Trading connectivity to CEDX for XTP Execution customers extends market coverage of our cleared derivatives front-office suite and further consolidates ION Markets’ leading position in the industry,” says Francesco Margini, chief product officer for cleared derivatives at ION Markets, in a prepared statement.

“Direct connectivity through the XTP Execution service will help to increase CEDX’s footprint across Europe ahead of its strategic expansion into single stock options,” says Iouri Saroukhanov, head of European Derivatives, Cboe Europe, in a statement.

https://www.ftfnews.com/isitc-explores-tokenized-commodities-other-news/