Though earnings expectations had been excessive following a giant run-up, Nvidia’s (NVDA) – Get Report inventory is up about 2.5% in Friday buying and selling, as markets give a thumbs-up to an April quarter beat and stable July quarter steering.

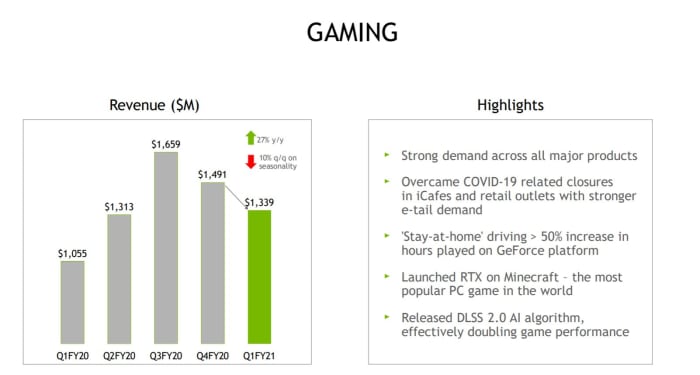

Nvidia’s Gaming phase income rose 27% yearly final quarter to $1.34 billion, aided by sturdy demand for pocket book GPUs and the Nvidia-powered Nintendo Switch console. Data Center phase income rose 80% to $1.14 billion, with assists from sturdy cloud capital spending and preliminary shipments of Nvidia’s new flagship server GPU, the A100.

Following Nvidia’s earnings name, I as soon as once more had an opportunity to speak with CFO Colette Kress about her firm’s outcomes and near-term gross sales expectations (an article going over February’s incomes name might be found here). Here’s a take a look at feedback that Kress shared on a number of topics of curiosity, barely edited for readability.

How Nvidia’s gross sales to conventional enterprises (referred to by the corporate as “vertical industries” purchasers) are trending amid the COVID-19 pandemic.

“In our information heart enterprise, [hyperscalers were] very sturdy, but in addition our vertical industries. Both of them rose within the quarter. Our industries [business] nonetheless stays…solidly within the double digits [as a percentage of] our total Data Center enterprise.

There are undoubtedly some areas the place we’re serving to clear up some of the issues [caused by] COVID-19. But given the place the economic system [is], there are some companies which may be just a little slower in phrases of [how fast they buy] our new information heart merchandise simply as a consequence of COVID-19. An instance could be the automotive business.”

On whether or not Nvidia’s gross sales to web/cloud giants (i.e., hyperscalers) benefited from orders that had been positioned to assist take care of visitors spikes attributable to COVID-19.

“We don’t have any alerts that there have been any pull-ins or any particular total buying. As we’ve mentioned, we had visibility going into the quarter in phrases of what individuals had been buying and what they had been needing.

We had began to debate with [hyperscalers] our subsequent structure which got here out throughout the quarter. But no, we don’t have any information of any materials…pull-ins throughout the quarter.”

Nvidia’s near-term gross sales expectations for its recently-announced DGX A100 server, which incorporates eight A100 GPUs.

“We have all the time had sure quarters the place we’ve giant DGX gross sales as a share of [Data Center revenue], and different quarters the place it’s not as giant. It’s nonetheless just a little bit too early…we’re simply going to need to see what [demand] appears like for the complete quarter.

We anticipate extra [sales] of our A100 boards…throughout the quarter, and we’re simply going to begin promoting our [DGX A100 server].”

How Nvidia’s pocket book GPU gross sales are trending as a portion of its whole Gaming phase income, and — provided that Nvidia mentioned it noticed a good gaming GPU combine final quarter — whether or not it noticed a combination shift in direction of its extra highly effective RTX-series GPUs relative to its much less highly effective GTX-series GPUs.

“During the quarter, our pocket book enterprise completed [its] ninth quarter of year-on-year progress…Our pocket book enterprise was aided by COVID-19, by individuals transferring to e-tail [purchases]. Our pocket book enterprise…now represents virtually 30% of our total Gaming enterprise.

We bought virtually the complete stack in phrases of [our notebook GPU sales]. We had some notebooks that [featured] our RTX and higher-end [GPUs], and we had been more than happy with their efficiency throughout the quarter. [We introduced] the Super 2080 in addition to the Super 2070. We additionally introduced the [RTX] 2060 to…a retail value level of $999.

We are persevering with to see an uplift in RTX as a share of our total enterprise because of this of these actions.”

On the order progress Nvidia has seen from Nintendo, whose Switch console has been bought out at main retailers, and its expectations for July quarter (fiscal Q2) gross sales to Nintendo.

“Nintendo has indicated that they had been seeing a pickup…related to COVID-19. We are working with them diligently to guarantee that they will meet their total demand, so we are going to anticipate a rise in [console-related shipments] between Q1 and Q2. We’re right here to help Nintendo…and so they’re serving to us perceive what their forecast will seem like.”

Nvidia is a holding in Jim Cramer’s Action Alerts PLUS Charitable Trust Portfolio. Want to be alerted earlier than Cramer buys or sells NVDA? Learn more now.